JUSHI: Chinese giant, whose profits have soared by 236%

Recently, the three quarterly reports of China Jushi came out. On the whole, the company’s volume and price resonated in the third quarter, with revenue and profit reaching new highs.

At the same time, affected by the sharp increase in natural gas prices and the increased depreciation of new production lines, the company’s sales gross profit margin decreased by 4 percentage points from the previous month to 45.45%.

In addition, it is worth noting that the company’s net profit deducted from the parent company in the third quarter declined slightly from the previous quarter. It is expected that it may be affected by the provision of excess profit sharing plan (2021Q3 management expenses increased by 204 million yuan year-on-year, and 197 million yuan month-on-month).

After deducting the impact of excess profit sharing, the company’s net profit deducted from the parent company will still maintain double-digit growth.

As an alternative and enhanced material, glass fiber has increased the price of steel and aluminum this year, and glass fiber has become more cost-effective. The application of glass fiber in various downstream fields is also increasing, and the replacement rate of glass fiber is expected to further increase in the future.

Looking ahead, we believe that the certainty of new energy vehicles, wind power and PCB is high, and the demand for glass fiber will continue to grow steadily. As the leader of the glass fiber industry, with the continuous expansion of subsequent production capacity and the continuous decline in costs, the company’s growth attributes are prominent, and the growth logic is still clear.

1. The volume and price are rising, and the performance is more in line with expectations

For China Jushi, we used 4 articles to analyze the company in detail from 4 perspectives: finance, industry and competition, future development space, risk and valuation .

Let’s take a look at the three quarterly reports of China Jushi in detail, let’s talk about the data first. In the first three quarters of 2021, the company achieved revenue of 13.836 billion yuan, a year-on-year increase of 75.69%, and net profit attributable to the parent was 4.305 billion yuan, a year-on-year increase of 236.4%. The performance maintained a rapid growth trend.

Among them, the operating income in the third quarter was 5.276 billion yuan, a year-on-year increase of 76.81%, and a month-on-month increase of 15.6%; net profit attributable to the parent was 1.708 billion yuan, a year-on-year increase of 230.08%, and a month-on-month increase of 11.3%. The single-quarter revenue and profit were both record highs. Basically in line with our expectations.

Previously, we predicted that the performance of Jushi will continue to grow rapidly, mainly based on the following four logics.

1. The peak period of completion in the second half of this year will continue, and the growth rate of completion throughout the year may improve significantly, which will greatly increase the demand for glass fiber at the completion end.

2. The wind power industry is developing rapidly, and the newly installed wind power capacity continues to increase. In addition, with the increasing capacity of wind turbine models, wind turbine blades are evolving toward large-scale development, and the amount of glass fiber required per MW of wind turbine blades has increased, which is good for the long-term demand for glass fiber products for wind power.

3. As an important substitute for traditional metal materials in the field of automotive lightweighting, glass fiber composite materials have witnessed rapid growth in demand with the automotive industry’s energy conservation and emission reduction and the promotion of new energy vehicles in recent years, and the penetration rate of new materials is expected to increase.

4. The implementation of “Made in China 2025” has broadened the application range of PCBs and promoted an increase in the demand for electronic yarn/electronic cloth. In addition, the imbalance of supply and demand in the first half of the year was superimposed, which caused the price of electronic yarn to rise sharply. As the new production line is put into operation, the company’s electronic yarn business will bring new opportunities.

As for China Jushi’s third-quarter report, it is mainly due to the strong demand for fiberglass downstream applications and the significant increase in the export sales of fiberglass products. On the other hand, the volume and price of the company’s roving products have risen, and the price of electronic cloth has also risen sharply.

Therefore, the company’s performance in the third quarter also maintained rapid growth, which confirmed our judgment to a certain extent.

2. Increase in fuel costs and increase in depreciation, gross profit margin decline from the previous month

Increase in fuel costs and increase in depreciation, gross profit margin decline from the previous month

Behind this beautiful three-quarter report, there is one point worthy of our attention, that is, the company’s gross profit margin in the third quarter fell by 4 percentage points from the previous quarter to 45.45%.

The increase in the cost of raw materials and fuels and the increase in depreciation of new production lines are the main reasons that drag down the company’s gross profit margin.

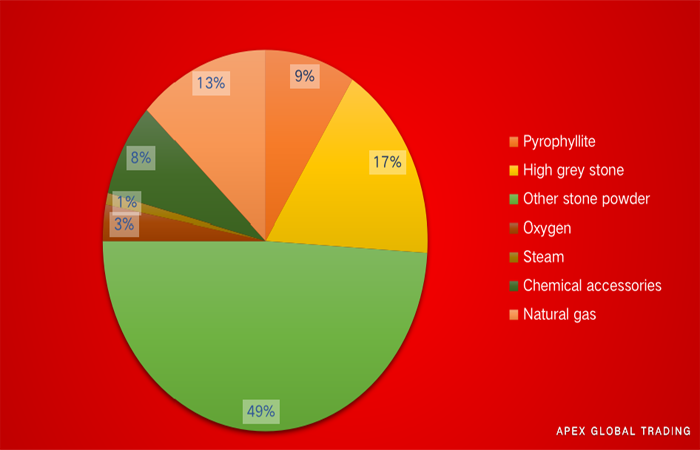

From the perspective of China Jushi’s main raw material/energy cost ratio, natural gas and electricity are important aspects of its cost composition. The two accounted for 13% and 12% of the company’s cost respectively, reaching a total of 25%.

Since the third quarter (as of October 26, 2021), China’s LNG (liquefied petroleum gas) price has increased from 3750 yuan/ton by 86.76% to 7003.33 yuan/ton. At the same time, due to the impact of power restrictions and production restrictions, many provinces have adjusted the prices of electricity produced by enterprises, and the increase in electricity prices has further increased the cost pressure on the company.

On the other hand, the company’s Tongxiang Roving Smart Line 3 was ignited in mid-May and Smart Line 4 was ignited at the end of August. The commissioning of the new production line also led to an increase in depreciation. Together with the increase in raw material and fuel costs, the combined effect led to the company’s third quarter gross profit margin.

In response to the increasing cost pressure, China Jushi issued a price increase notice on September 21. Starting from October 1, 2020, the sales price of glass fiber roving and products will continue to be revised upwards by 10% (signed The contract is still executed according to the original contract).

The company has previously issued a price increase statement on August 25. Since September 1, the sales price of domestic glass fiber roving and products has been increased by 7%. This price increase is again after the previous price increase. The difference from last time is that the price increase this time is larger and includes overseas products, which to a certain extent also reflects the rapid recovery of overseas fiberglass demand.

As the company’s new phase of price increases began to land in October, we believe that the company’s product price center will move up as a whole, which will offset the pressure of rising costs to a certain extent, and increase the flexibility of annual performance.

3. The downstream demand is more certain and the growth logic remains unchanged

As an alternative and enhanced material, glass fiber has increased the price of steel and aluminum this year, and glass fiber has become more cost-effective. From the comparison of various downstream fields, chopped strand products for automobiles have the most obvious substitution, with rapid growth and large demand.

At the same time, the application of glass fiber in high-speed rail, wind power, pipe network and other application fields is also increasing, and the replacement rate of glass fiber is expected to further increase in the future.

In terms of new energy vehicles, on October 26, the State Council issued the “Carbon Peak Action Plan by 2030”, proposing to promote the low-carbon transformation of transportation equipment, and actively expand new energy and clean energy such as electric power, hydrogen energy, natural gas, and advanced bio-liquid fuels. Energy is used in the field of transportation. It pointed out that by 2030, the proportion of new energy and clean energy-powered vehicles will reach about 40%, and this will directly drive the demand for glass fiber composite materials.

In terms of wind power, on October 17, 118 cities and more than 600 wind power companies jointly launched the “Wind Power Partnership Action · Zero Carbon City Fumei Village” action. The action plan pointed out that we will strive to start a 5GW demonstration project by the end of 2021, and the total installed capacity during the “14th Five-Year Plan” period will reach 50GW.

On October 20th, the General Department of the National Energy Administration issued the “Notice on Actively Promoting the Consolidation of New Energy Power Generation Projects and Multiple Issues”, which required speeding up the construction of wind power projects and timely grid connection.

The continuous increase of favorable policies will stimulate the vitality of the industry to a large extent. In the future, domestic new installed wind power installed capacity will also maintain rapid growth, which will also benefit the long-term demand for glass fiber products for wind power.

From the perspective of the supply side, in the context of the “dual control of energy consumption” and “dual carbon” policies, in addition to environmental protection requirements, the glass fiber industry has continued to tighten its energy assessment indicators. It is expected that the production and capacity increase of small enterprises will be more difficult in the future. Increase, the supply side is expected to continue to improve, and industry concentration is expected to further increase.

Looking ahead, we believe that the certainty of new energy vehicles, wind power and PCB is high, and the demand for glass fiber will continue to grow steadily. As the leader of the glass fiber industry, with the continuous expansion of subsequent production capacity and the continuous decline in costs, the company’s growth attributes are prominent, and the growth logic is still clear.