China Jushi Special Report: Growth-oriented glass fiber leader, leading profitability in the industry

(Report Producer/Author: Great Wall Securities, Puyang)

1. Company introduction: a global leader in the fiberglass industry with a complete range of products

The company is the world’s leading enterprise in the glass fiber industry, and its main business is the production and sales of glass fiber and products, of which glass fiber yarn is the company’s main product.The company has five production bases in Tongxiang in Zhejiang, Jiujiang in Jiangxi, Chengdu in Sichuan, Suez in Egypt, and South Carolina in the United States. It has built more than 20 large-scale glass fiber drawing production lines in tank kilns with an annual production capacity of 2 million tons of fiberglass yarn. The company is located in Canada and Hong Kong. , South Africa, Brazil, Japan, South Korea, India, Italy, Spain, France and other countries and regions have production and trading overseas holding subsidiaries, and the marketing network radiates the world.The company’s glass fiber products have a wide range of products and a complete category. There are more than 100 categories and nearly 1000 specifications, including glass fiber products such as alkali-free glass fiber roving, chopped strands, chopped mat, checkered cloth, electronic cloth, etc. .

The controlling shareholder and actual controller of the company is China National Building Material Co., Ltd., with a shareholding ratio of 26.97%.As of the 2021 semi-annual report, major shareholders include China National Building Material Co., Ltd. (26.97%), Zhenshi Holdings Group Co., Ltd. (15.59%), Hong Kong Securities Clearing Company Limited (8.76%), National Social Security Fund 101 Portfolio (0.94%), etc. .

In 2020, the company achieved operating income of 11.66 billion yuan, an increase of 11.18% year-on-year; the net profit attributable to shareholders of the parent company was 2.416 billion yuan, an increase of 13.49% year-on-year。Since 2015, the company’s operating income has shown an upward trend, with a compound growth rate of 10.58%. In terms of net profit attributable to the parent, except for the increase in revenue in 2019, there has been a steady increase in the rest of the year, and the growth rate has gradually slowed down.In the first half of 2021, the company achieved operating income of approximately 8.56 billion yuan, an increase of 75% year-on-year; net profit attributable to the parent was approximately 2.597 billion yuan, an increase of 240.68% year-on-year.

The main source of the company’s operating income is the sales of glass fiber yarn and products.In 2020, the company’s glass fiber yarn and products will achieve operating income of 11.046 billion yuan, an increase of 11.1% compared to the previous year, accounting for 94.68% of the total operating income.In terms of gross profit margin, the gross profit margin of glass fiber yarn and products continued to grow from 2015 to 2018. In 2018, the gross profit margin reached a recent high of 47.05%; in 2019, due to the reclassification of the original part of the sales expenses to operating costs, the gross profit margin decreased by 10.2%; in 2020 , Due to the impact of domestic and foreign epidemics, the price of glass fiber products has decreased, which has led to a decline in gross profit margin.From the perspective of revenue structure, in 2020, fiberglass yarn, fiberglass products, electronic yarn and electronic cloth, and others account for 80%, 5%, 10%, and 5% respectively.

2. Company business: “Jushi Zhizhi” enhances the company’s profitability and has excellent growth capabilities during the 14th Five-Year Plan

2.1 Production and sales continue to increase, and capacity utilization rate maintains a relatively high level

Production and sales continue to increase, and revenue from main products maintains good growth

In 2020, domestic downstream demand for glass fiber and products is strong. The company’s total output will reach 2.072 million tons, and the capacity utilization rate will be 92.15%. Benefiting from the increased demand in the downstream market of glass fiber and the expansion of the company’s production capacity, the company’s output has continued to increase in recent years; in 2020, the output of alkali-free glass fiber yarn will be 1.913 million tons, and the output of glass fiber products will be 94,200 tons.In general, the output of alkali-free glass fiber yarn accounts for more than 80% of the company’s total output and is the company’s most important product.At the same time, due to the strong downstream demand for electronic cloth and the company’s new production lines, the company’s electronic cloth output will reach 381.426 million meters in 2020, an increase of 13.41% year-on-year, and the capacity utilization rate will reach 108.98%.In terms of sales volume, the company’s total product sales have steadily increased. In 2020, the company’s comprehensive production and sales rate reached 103.92%, an increase of 15.14 percentage points from 2019.In 2020, the company’s glass fiber yarn sales volume was 1,989,300 tons, a year-on-year increase of 21.9%; glass fiber products sales volume was 96,500 tons, a year-on-year decrease of 15.9%.

The production and sales rate of the company’s products has remained at a good level in the past three years. The production, sales, and production and sales rates of alkali-free glass fiber yarn, which accounted for the largest proportion, have been maintained at a relatively high level.。From 2018 to 2020, the company’s sales volume further increased year-on-year, and the comprehensive production and sales ratios (excluding electronic yarn and electronic cloth) were 93.24%, 88.78%, and 103.92%, respectively.The decrease in production and sales in 2019 compared with 2018 was mainly due to the cyclical overcapacity in the industry and the increasing downward pressure on the global economy, the contradiction between supply and demand appeared, and production exceeded sales.In 2020, the company’s comprehensive production and sales rate was 103.92%, a significant increase from 2019, mainly because the company adjusted its product structure in a timely manner for the domestic market, actively expanded its major customers, gave full play to its layout advantages to seize market share, and continuously increased its growth in new markets. As a result, the company’s main products, glass fiber yarn and products, continue to increase sales.

In terms of product prices, relying on strong scale advantages and cost control advantages, the company has strong market pricing power。On September 1st and October 1st, 2020, the product prices were increased by 7% and 10% respectively. However, due to the lower prices in the first half of the year, the annual sales prices still fell year-on-year.In the first quarter of 2021, the market’s supply and demand boom continued, and the average market price rose by 21.40% from the previous quarter in 2020.(Report source: Future Think Tank)

In 2020, the company’s main business revenue was 11.461 billion yuan, an increase of 10.85% year-on-year; of which alkali-free glass fiber yarn was the company’s main source of income, operating income was 9.295 billion yuan, accounting for 81.1%。The operating income of electronic cloth has increased year by year, from 7.26% in 2018 to 10% in 2020. Electronic cloth is the key direction of the company’s future development.

Domestic sales revenue has risen steadily, and the impact of overseas trade policies has not yet been eliminated

Domestic sales are mainly direct sales, supplemented by agents. Benefiting from the growth of domestic demand, the company’s revenue has been expanding in recent years. The company’s foreign sales use a combination of subsidiary sales, dealer sales and direct sales.。Sales are mainly carried out through direct communication with customers through the domestic sales company under the subsidiary Jushi Group.The domestic sales company has five areas: Jiangsu, East China, South China, North China, Southwest and Northwest China, to cater to customers in different regions.Among them, Jiangsu and East China are the company’s most important sales markets, and the demand in the two regions is mainly for medium and high-end products, with good customer quality.20-30% of foreign sales are direct sales, about 9% are sold through distributors, and the rest are sold through overseas subsidiaries.The company currently has 16 overseas sales subsidiaries, including Jushi South Africa China Composites, Jushi Hong Kong China Composites, Jushi Hong Kong, and Jushi Brazil.The company has exclusive distributors in the UK, Germany and other places. In the next few years, the company will also consider setting up trading companies in the Middle East, Turkey, Australia and other countries and regions to continuously improve the sales network.In 2020, the company’s top 5 customers totaled 2.273 billion yuan in sales, accounting for 19.49% of total operating income.The company’s relationship with major customers has a certain impact on the company’s overall profitability.

In 2020, the company’s foreign operating income will be 3.734 billion yuan, accounting for 32.58%. At the same time, domestic operating income continues to increase. In 2020, it will be 7.727 billion yuan, accounting for 67.42%, which is an increase of 16.06 percentage points from 51.36% in 2016 . In overseas sales, North America accounts for approximately 30% of exports, Europe accounts for 22%, Asia accounts for 37%, and other countries and regions account for approximately 11%. In terms of foreign markets, the anti-dumping and countervailing policies for overseas trade in the glass fiber market in 2020 have not been cancelled. Coupled with the impact of the new crown epidemic, overseas market revenue will be affected.

2.2 The two-wheel drive of “capacity expansion + technological innovation” creates new growth points for business

Capacity expansion: The layout of production lines is becoming more and more perfect, consolidating the foundation for future development

Alkali-free glass fiber is the company’s main product. It is a kind of aluminum borosilicate composition. It has the characteristics of high chemical stability, good electrical insulation performance, high mechanical strength, and good water resistance. It is suitable for electrical insulation materials, plastics and rubber. Reinforcement materials for products, etc. There are three main glass fiber production processes: clay crucible method, platinum crucible method and pool kiln wire drawing method. The pool kiln drawing method is currently the most advanced process method, and it is a leap in glass fiber manufacturing technology. According to China Fiberglass Information Network, the average energy consumption of traditional clay crucible glass fiber is 5 tons of standard coal per ton of yarn; the average energy consumption of platinum crucible glass fiber is 2-4 tons of standard coal per ton of yarn; The average energy consumption of kiln glass fiber is reduced to 1 ton of standard coal/ton of yarn; the energy consumption of tank kiln glass fiber that adopts “pure oxy-fuel combustion technology” is greatly reduced to about 0.4 ton of standard coal/ton of yarn. The amount is reduced by 80%, effectively reducing nitrogen dioxide emissions. At present, Jushi Company mainly adopts the pure oxygen combustion tank kiln method.

As of the end of March 2021, the company had a total of 19 glass fiber tank kiln drawing production lines and 2 electronic cloth production lines in production, and the total production capacity of various glass fiber products was 1.996 million tons . Domestically, the company has 7 large glass fiber tank kiln drawing production lines and 1 environmentally friendly waste silk drawing production line in the Tongxiang headquarters. Among them, the second phase of the Tongxiang intelligent manufacturing base roving production line will produce 150,000 tons of alkali-free glass fiber pool kiln drawing production lines. It will be ignited on June 9, 2020. After the expansion, the production capacity of the headquarters will reach 995,000 tons/year. It is currently the largest and most technologically advanced glass fiber production base in China. In terms of overseas production capacity layout, the company has 4 production lines that have been put into production; among them, the Egyptian base has 3 production lines with a total production capacity of 200,000 tons/year. The production line in South Carolina, USA has a production capacity of 96,000 tons/year, with a total investment of US$347 million. The establishment of overseas production lines is conducive to the further improvement of the company’s global layout, the overseas supply capacity and market share of products are effectively improved, and the scope of product radiation is expanded, which helps reduce the impact of anti-dumping.

The company has sufficient reserves of projects under construction and is expected to create new profit growth points . According to the company’s 2021 semi-annual report, the third roving production line with an annual output of 150,000 tons and the second production line with an annual output of 60,000 tons of spun yarn and 300 million meters of electronic cloth at the Tongxiang headquarters have achieved pre-ignition and reached production standards. The construction of a roving production line with an annual output of 150,000 tons and a third production line with an annual output of 100,000 tons of spun yarn and 300 million meters of spun yarn electronic cloth is progressing on schedule. In addition, the company announced on August 18 this year that it will invest in the construction of the Jushi Egypt Fiberglass Co., Ltd. annual output of 120,000 tons of glass fiber tank kiln drawing production line, with a total investment of US$335,460,500 and a construction period of 1.5 years.

Technological innovation: increase investment in research and development, focus on mid-to-high-end products

Continuous technological innovation is the company’s core competitiveness and the driving force to promote the company’s sustainable development . At present, the company has 15 innovation platforms above the provincial level, including 5 at the national level. The company has set up a technology center to vigorously support R&D and innovation activities and continuously strengthen the construction of R&D teams. In 2020, the company obtained a total of 98 patent authorizations, including 48 invention patents, including 31 foreign-related invention authorizations. A total of 705 valid patents have been authorized globally, including 253 invention patents (including 105 foreign-related inventions) and 457 utility model patents. A number of scientific research projects have won the third prize of Zhejiang Science and Technology Progress Award, the second prize of China National Building Materials Group Science and Technology Progress Award, Zhejiang Manufacturing Boutique, and Zhejiang Patent Excellence Award.

In recent years, the company’s R&D investment has continued to rise. In 2020, R&D investment will reach 342 million yuan, accounting for about 3% of sales revenue; the number of R&D personnel is 1,766, accounting for 15.07% of the company’s headcount. As of 2020, the company has 12 doctors and 107 masters. There are more than 300 scientific and technological talents engaged in glass fiber product research and development, glass raw material and formula research, and glass fiber equipment development. They have become the core support force for the company’s sustainable and effective development.

2.3 The cost advantage is prominent, and the profit level leads the peers

Upstream and downstream bargaining power is improved, and raw material procurement costs are reduced

In 2020, the company’s purchase price of pyrophyllite is 432.07 yuan/ton, and the purchase price of natural gas is 2.34 yuan/m3; the purchase price of Taishan fiberglass pyrophyllite is 580 yuan/ton, and the purchase price of natural gas is 2.82 yuan/m3 . The purchase price of the company’s pyrophyllite is 148 yuan/ton lower than that of Taishan fiberglass, and the purchase price of natural gas is 0.48 yuan/m3 lower. According to China Jushi’s 2020 pyrophyllite purchase volume of 1.24 million tons, and the average purchase price of 432 yuan/ton, the total purchase amount of pyrophyllite is 535 million yuan; if the purchase price of Taishan fiberglass is 580 yuan/ton, the total purchase of pyrophyllite is 719 million yuan. As a result, the company’s raw material procurement costs have certain advantages compared with peer companies.

In the production cost composition of glass fiber, raw materials account for about 30%, and energy and power, labor costs, and equipment depreciation costs total about 70%. The raw materials for glass fiber production mainly include pyrophyllite, quartz sand, sizing agent, etc., and energy power includes natural gas and electricity. There are three main reasons for the low purchase price of pyrophyllite: (1) scale advantage; (2) industrial chain integration advantage (3) geographical advantage. On the one hand, the company has a strong scale advantage: China Jushi is a leading global fiberglass manufacturer with a leading production scale, and the quantity and amount of pyrophyllite to be purchased far exceeds that of its peers. In 2020, the company’s purchase of pyrophyllite is 1,240,600 tons, and Taishan fiberglass is 454,100 tons, and the company’s purchase is three times that of Taishan fiberglass. On the other hand, the company is gradually moving to the upstream of the industrial chain to reduce the cost of raw materials. In 2012, China Jushi acquired Tongxiang Leishi, the world’s largest producer of pyrophyllite powder for glass fiber. The company’s pyrophyllite is mainly provided by its subsidiary Tongxiang Leishi. Currently, Tongxiang Leishi has a production capacity of 1.3 million tons of pyrophyllite powder per year, which can largely meet the company’s pyrophyllite procurement needs. In addition, the company has unique geographical advantages that its peers do not have. The domestic pyrophyllite reserves are 55 million tons, which are concentrated in Zhejiang and Fujian provinces, which account for about 80% of the resource reserves. China Jushi is located in Zhejiang, where pyrophyllite resources are abundant and the transportation distance is short, so the purchase price of pyrophyllite is lower than that of competitors.

The energy supply is strongly guaranteed, and the equipment is cold repaired to reduce energy consumption

In terms of natural gas, the company adopts the principle of “annual bidding and open bidding” for upstream suppliers, and reduces procurement costs through competitive negotiation, multiple price comparisons, and signing of long-term agreements . The Zhejiang Provincial Government has also provided strong support for the company’s energy supply. The government arranged for the company a quantitative pipeline of natural gas supply. In the natural gas pipeline project, the Tongxiang Jushi branch of the Deqing-Jiaxing natural gas pipeline was opened to ensure the company’s natural gas supply. In addition, the continuity of fiberglass tank kiln production is very dependent on the stability of natural gas supply. The company has established a diversified emergency energy reserve to ensure continuous fuel supply. The company has built natural gas source stations and large-scale liquefied gas storage tanks, and the stored fuel can be enough for the company’s normal production for about a week. Secondly, the company is equipped with on-board compressed natural gas as a further temporary gas reserve and supplement.

The company further reduces the energy consumption and power consumption of the kiln through the technical transformation of the cold repair of the kiln, thereby saving energy costs. The specific process of the pool kiln drawing method is to melt the pyrophyllite and other raw materials in the kiln into a glass solution, remove the bubbles and transport it to the porous slat through the passage, and draw the glass fiber strand at high speed. The kiln can pass through multiple passages. Connect hundreds of missing plates and produce at the same time. The quality of the kiln is directly related to the energy loss, so the company reduces energy consumption through technical renovation of the tank kiln. In the first half of 2021, the company initiated the cold repair technical transformation of a 40,000-ton high-performance glass fiber tank kiln drawing production line that was put into operation in 2015. After the transformation is completed, it will produce direct untwisted roving with an annual design capacity of 50,000 tons; in 2021 In December, the company plans to start the renovation project of the 80,000-ton fiberglass tank kiln wire drawing production line in Egypt that was ignited and put into operation in 2013. After the renovation is completed, it will produce reinforced fiberglass products with an annual design capacity of 120,000 tons.

On the other hand, the company’s existing furnaces also use internationally advanced three-dimensional pure oxygen combustion technology in the melting section to improve heat energy utilization efficiency and effectively reduce fuel consumption . According to the company’s official website, the comprehensive energy consumption of glass fiber roving products in 2020 decreased by 0.73% year-on-year, and the comprehensive energy consumption of glass fiber spun yarn products decreased by 0.33% year-on-year; the unit comprehensive energy consumption of glass fiber products decreased by 6.52% year-on-year. Energy consumption decreased by 2.79% year-on-year. (Report source: Future Think Tank)

Smart production superimposed on refined management to improve production efficiency

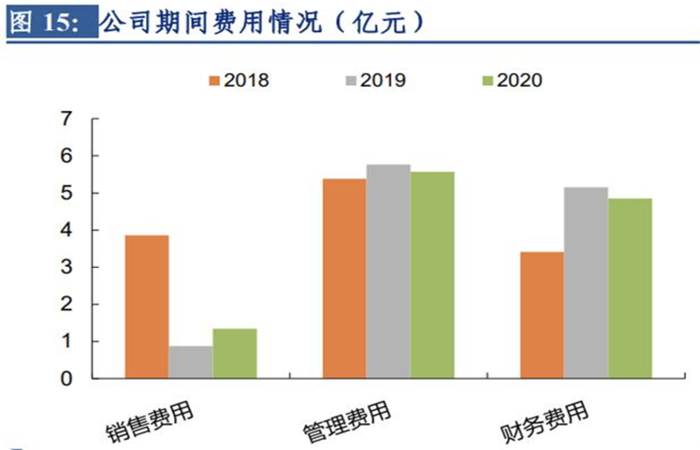

In 2020, the company’s sales expenses will be 134 million yuan, management expenses will be 557 million yuan, and financial expenses will be 485 million yuan, which is generally stable. The company actively adopts various methods to improve efficiency to control costs, including increasing furnace melting rate and wire drawing yield, thereby increasing the output of a single furnace; increasing the degree of automation, reducing labor, thereby reducing labor costs; establishing and improving the evaluation of product production costs System is the core cost control management system. The overall design, process flow, and layout of the company’s smart factory realize digital modeling; through the implementation of the project, Jushi has built a benchmark factory for smart manufacturing in the glass fiber industry, realizing digital, networked, and intelligent glass fiber production. The company’s 200 million-meter electronic cloth production line basically uses automated logistics for all logistics and transportation, and the multi-process fully automated warehouse maximizes the use of space. Multi-process logistics intelligent distribution, logistics and vehicles automatically enter and exit the warehouse, realize the automatic generation of material coding and production reports, and greatly improve management efficiency. The company has innovated its management and control model, based on the principle of market economy, and implemented re-optimization of personnel, re-improvement of efficiency, re-division of labor, re-decentralization, and re-improvement of control to maximize cost advantages.

In the past three years, China’s Jushi and Taishan fiberglass products have been in a good downward path during the period of a single ton of fiberglass products, and the cost control effect has been significant. In 2020, the cost per ton of China’s Boulder is 727 yuan, and that of Taishan Fiberglass is 716 yuan. The cost of the two companies is equivalent. From 2018 to 2019, China Jushi has a significantly lower cost per ton than Taishan Fiberglass, which has a leading cost advantage.

3. Profit forecast

Important assumptions for profit forecasts :

According to the company’s announcement, the company’s recent roving production capacity includes: in June 2020, the second phase of the roving production line of the Tongxiang headquarters intelligent manufacturing base with an annual output of 150,000 tons of alkali-free glass fiber pool kiln drawing production line ignition; July and September 2020 Chengdu production base The production line with an annual output of 130,000 tons of alkali-free glass fiber tank kiln and the production line with an annual output of 120,000 tons of alkali-free fiberglass tank kiln were successfully ignited; in May 2021, the third intelligent manufacturing base of Tongxiang headquarters with an annual output of 150,000 tons of roving The production line is ignited; in August 2021, the Jushi Group Co., Ltd.’s annual production of 150,000 tons of glass fiber chopped strands production line construction project is ignited; in August 2021, the company announced to invest in Jushi Egypt Fiberglass Co., Ltd. with an annual output of 120,000 tons of glass fiber pool kiln drawing The production line construction project has a construction period of 1.5 years. (Report source: Future Think Tank)

According to the company’s announcement, the company’s recent cold repair of roving capacity includes: In April 2021, the company carried out cold modifications to the high-performance glass fiber kiln drawing production line with an annual output of 40,000 tons. Ton, the project construction period is 6 months; in September 2021, the first glass fiber kiln drawing production line with an annual output of 80,000 tons in Tongxiang base will be cold modified. After the technical transformation is completed, the production line capacity will be increased to 100,000 tons. The construction period is 1 year; in December 2021, the company plans to cold-modify the first 80,000 tons of glass fiber pool kiln drawing production line at the Jushi Egypt base into a glass fiber drawing production line with an annual output of 120,000 tons. The construction period of the project is 6 months. .

In the first half of this year, the company’s sales volume of roving and products reached 1.1019 million tons.According to the above-mentioned production capacity deployment and cold repair plan, the company’s roving sales growth rate is expected to reach 17%, 15%, and 15% respectively from 2021 to 2023.The company’s sales of fiberglass products have grown steadily, and the compound sales growth rate is expected to reach 5% from 2021 to 2023.According to the current price trend of glass fiber, the average sales price of roving and glass fiber products from 2021 to 2023 is expected to increase by 37%, 0%, and 0% year-on-year; the unit cost will increase by 8%, 0%, and 0% year-on-year.

According to the company’s announcement, the company’s recent investment in electronic yarn and electronic cloth projects includes: On March 16, 2021, China’s Jushi Intelligent Manufacturing Base, with an annual output of 300 million meters of electronic cloth intelligent manufacturing line, was successfully ignited; Jushi Group Co., Ltd. with an annual output of 100,000 tons of electronic Yarn and an electronic cloth production line with an annual output of 300 million meters is expected to be put into operation in the first half of next year.It is estimated that the company’s sales of electronic cloth from 2021 to 2023 will increase year-on-year by 40%, 66%, and 25% respectively.According to the current price trend of glass fiber, the average sales price of electronic cloth is expected to increase by 22%, 0%, and 0% year-on-year from 2021 to 2023; the unit cost will increase by 8%, 0%, and 0% year-on-year.