Glass fiber industry, future geometry?

The glass fiber industry has obvious cyclical characteristics. With the continuous growth of electronics, automobiles, wind power and other fields, the future market prospects are broad.

As we all know, new materials are listed as one of the major directions of the “Made in China 2025” plan. As one of the important subdivisions, glass fiber is rapidly expanding.

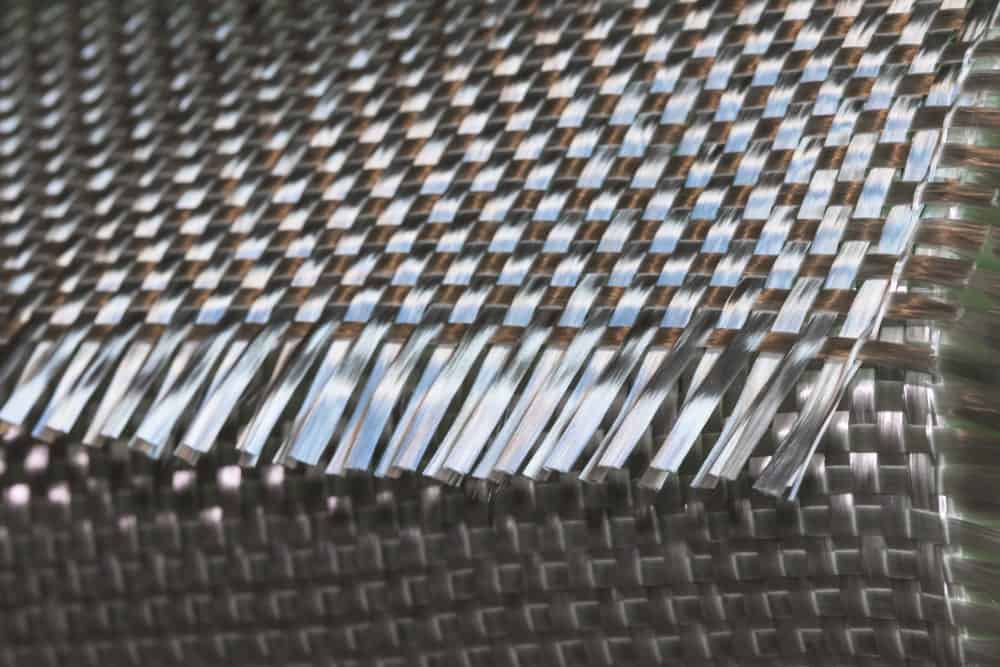

Glass fiber was born in the 1930s. It is an inorganic non-metallic material produced from main mineral raw materials such as pyrophyllite, quartz sand and limestone, and chemical raw materials such as boric acid and soda ash. It has low cost, light weight, high strength and high temperature resistance. Corrosion resistance and a series of advantages. Its specific strength reaches 833Mpa/gcm3, second only to carbon fiber (over 1800Mpa/gcm3) in common materials, and it is an excellent functional material and structural material.

The domestic market ushered in a period of expansion

Relevant institutions have calculated based on historical data that the average growth rate of the glass fiber industry is generally 1.5-2 times the country’s GDP growth rate. The growth rate is about 1.6 times the growth rate of industrial output. The calculation results of Huatai Securities show that from 2006 to 2019, the growth rate of global glass fiber demand has a good linear relationship with the year-on-year GDP and industrial added value. Among them, the growth rate of global glass fiber demand is about 1.81 times that of GDP. , 1.70 times the growth rate of industrial added value. However, historical data shows that the linear relationship between domestic glass fiber demand and macroeconomic indicators was weak in the past. In recent years, the ratio of glass fiber demand growth rate to GDP growth rate has been significantly higher than that of the world. In 2018 and 2019, the ratio was 2.4 and 3.0, respectively.

Tracing the source, this is directly related to the low penetration rate of glass fiber in China.

my country’s per capita annual glass fiber consumption is much lower than that of developed countries. In 2019, my country’s per capita glass fiber consumption is about 2.8kg, while the consumption of developed countries such as the United States, Japan, and the European Union is about 4.5kg.

The top three fields of glass fiber application in China are construction, electronic appliances, and transportation, accounting for 34%, 21%, and 16% respectively.

Among them, the largest consumption of glass fiber in the field of electronic appliances is the electronic cloth used to make the copper clad laminate (CCL) in the printed circuit (PCB), and the electronic cloth consumes most of the electronic yarn (about 95%). Domestic electronic yarns are being replaced by domestic products, and the proportion of imports in my country’s electronic yarn production has been decreasing year by year, and some high-end products have gradually achieved import substitution.

With the continuous advancement of 5G commercial use, the demand for PCBs has increased significantly. The large-scale construction of data centers and the increased demand for servers will become the biggest driving force for short-term growth in the PCB market. It provides long-term demand support for PCB, and there is a high probability that the electronic field will bring an incremental market to glass fiber in the future.

The trend of global energy and environmental policies has made lightweighting of transportation a long-term issue in the industry, and the application of lightweight materials such as glass fiber reinforced composite materials is one of the main approaches, but there is a big gap between my country and the world’s leading level. Germany, the United States, and Japan are countries that currently use a relatively high proportion of automotive lightweight materials. Among them, Germany’s automotive lightweight materials application accounts for about 25%, which is the highest in the world. my country’s automotive lightweight material application is in line with foreign advanced levels. There is a big gap. For example, the amount of aluminum and steel is about half of the international advanced level, and the amount of magnesium alloy is about 1/10 of the advanced level in Europe. There is still a large room for growth in the demand for glass fiber for automobiles in my country.

According to the data of China Fiber Composites Network, in 2021, the national glass fiber output will reach 6.24 million tons, compared with 258,000 tons in 2001, the CAGR of my country’s glass fiber industry in the past 20 years is as high as 17.3%. From the import and export data, the national export volume of glass fiber and products in 2021 will be 1.683 million tons, a year-on-year increase of 26.5%; the import volume will be 182,000 tons, maintaining a normal level.

Apex Global

Start late, progress fast

The domestic glass fiber industry has formed different positioning in different segments.

The domestic glass fiber industry has formed different positioning in different segments.

In the field of roving, China’s Jushi has the largest production capacity in the world, and has advantages in scale and cost. In the field of wind power yarns, Jushi and Taishan glass fiber have obvious advantages. The E9 and HMG ultra-high modulus glass fiber yarns developed by them have high technical content and can adapt to the challenges of large-scale blades. The technical requirements in the field of electronic yarn/cloth are higher, and Guangyuan New Materials, Honghe Technology, and Kunshan Bicheng are in a leading position. In the field of glass fiber composite materials, Changhai Co., Ltd. is the leader in subdivision, and has formed a complete industrial chain of glass fiber-resin-composite materials.

The three major enterprises of China Jushi, Taishan Fiberglass and Chongqing International are in the first echelon in terms of production capacity, and they are far ahead. The production capacity of the three companies in the production of glass fiber yarn accounts for 29%, 16% and 15% of the domestic production capacity. From a global perspective, the production capacity of the three domestic giants also accounts for more than 40% of the global total, and they are listed as the world’s six largest glass fiber companies along with Owens Corning, NEG (Japan Electric Glass), and the American JM Company. The six together account for more than 75% of global production capacity.

The glass fiber industry has obvious characteristics of “heavy assets”.

In addition to the cost of materials and energy, fixed costs such as depreciation also account for a large proportion. Therefore, the cost advantage has become one of the core competitiveness of enterprises. The core of glass fiber production cost is material, accounting for about 30%, of which domestic enterprises mainly use pyrophyllite as raw material, accounting for about 10% of production cost. Energy power accounts for about 20%-25%, of which natural gas accounts for about 10% of production costs. In addition, other cost items such as labor and depreciation together account for about 35%-40%. The internal core driving factor of the industry’s development is the decline in production costs. Throughout the development history of glass fiber, it is actually the history of cost reduction of glass fiber enterprises.

On the raw material side, several leading glass fiber leaders have improved the guarantee capability of mineral raw materials in terms of variety, quantity and quality by holding or participating in ore production enterprises. For example, China Jushi, Taishan Fiberglass, and Shandong Fiberglass have successively built their own ore processing plants to extend upstream in the industrial chain, reducing the cost of ore raw materials as much as possible. As the absolute leader in the domestic glass fiber industry, China Jushi has the lowest cost of raw materials.

If compared with overseas companies, there is not much difference in raw material cost between domestic and foreign companies. Based on the different resource endowments of different countries, local companies use pyrophyllite as raw material, while American companies mostly use kaolin as raw material, and the cost of ore is about 70 USD/ Ton.

In terms of energy cost, Chinese companies have disadvantages. The energy cost per ton of glass fiber yarn in China is about 917 yuan, and the energy cost per ton in the United States is equivalent to about 450 yuan. The energy cost in the United States is 467 yuan/ton lower than that in my country.

The glass fiber industry also has obvious cyclical characteristics. With the continuous growth of electronics, automobiles, wind power and other fields, the future market prospects are relatively broad, so the upward phase of the cycle is expected to be extended.